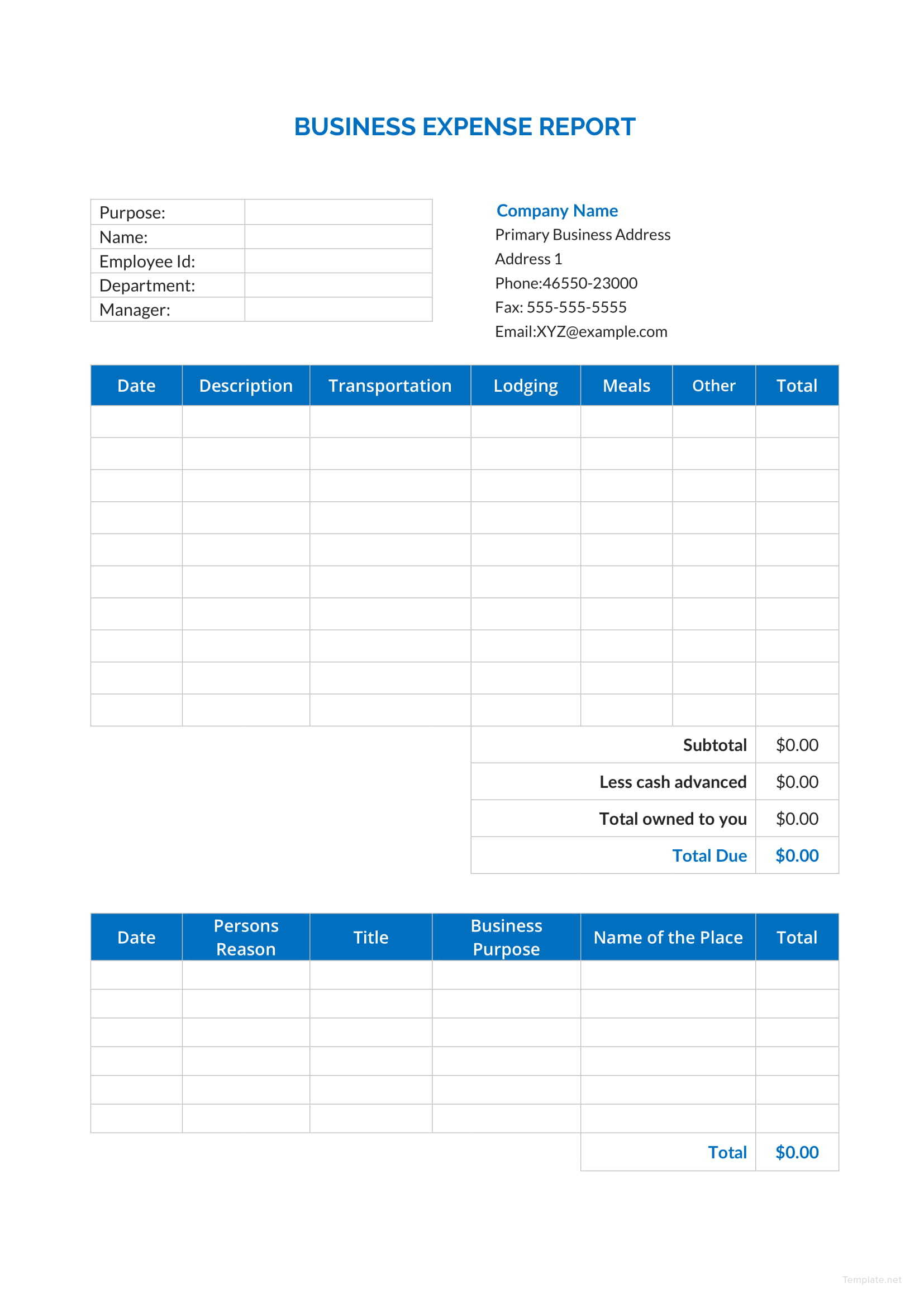

These well-crafted presentations will help you monitor the costs and expenses, which, if not carefully monitored, can lead to heavy losses for the company. This can be a frustrating and time-consuming process, especially when you have to do it regularly.īut with our predesigned templates, it’s easy to create an expense report. Maintaining a track of receipts, organizing them, and then turning all of them into an understandable and accurate report. In reality, business owners have a lot on their plate when it comes to managing expenses. So creating an expense report is a viable option, leaving you with more time to focus on other pressing tasks. It can provide factual data to back up statements if an audit occurs, help you stay organized, and allow you to back up audited numbers during settlement discussions. There are various reasons why maintaining an expense report is important. Furthermore, an expense report can be created for two types of directives – Internal and External. The expense report will enable them to show the details of expenditures and their utilization for official purposes.

An employee who has incurred expenses on account of their official travel, entertainment, or provision of services, can document the costs and share them with the finance department. Many companies use expense reports to oversee all business-related payments and then review these expenses when calculating an employee's final pay.Īn expense report can also be prepared by an individual for reimbursement. It is a document that details your expenditures for a specific period. It helps him monitor the costs and identify areas where the team can save money without sacrificing the quality of operations.Įxpense reports are a necessary evil in the world of business. He shares that one of the primary ways to keep track of the expenses is by creating a detailed expense report each month. This means that he is often intimately involved in the creation of the department's budget, which allows him to keep a close eye on the expenses. As a manager of a small department in a huge company, Michael finds himself in the unique position of being responsible for both, the day-to-day operations and the financial management of his department.

0 kommentar(er)

0 kommentar(er)